how we moved into an rv full time & paid off $74,200 in debt

- Updated: April 12, 2021

- Written By: Ginger Sorensen

Note: This post was written in July 2018, and much has shifted since it was first shared.

Journey To Euphoria’s focus is now on the mindset around simple living and not so much our personal journey.

However, this post in particular continues to be popular both on google and pinterst so we have left it in our archives to enjoy.

We hope you can be inspired by what we shared.

so here it goes…

July 2018

We have pondered over this post for a while now.

It is scary. VERY SCARY.

To put ourselves out there and share a piece of our lives we are not proud of is slightly embarrassing.

But here we are talking about our DEBT.

for some a four letter word.

We plan to write many posts that give tools and tips around living a debt free life and how to become debt free. As we do, we will link them here for reference. It is an important piece of this site as it’s the foundation of what will allow us to move forward with our dreams.

However, we felt this information about our personal journey was important to share as a starting point.

IT IS OUR WHY.

It is the reason we are doing what we are doing.

So with that…

HERE IS OUR STORY

Both Shane and I came into our marriage with a good amount of debt in 2011. When combined, it was not pretty and we both knew it going in.

But one thing we had in common was a desire to live life to it’s fullest. We started our marriage out with a beach wedding in Long Beach, CA and an 8 day cruise. We also helped a few friends come along. By the end of the celebration, the price tag was larger than we had originally planned. We then lived it up for the first 3 to 4 years with grand vacations, stuff AND a hefty business loan that… well… looking back was maybe not the best investment.

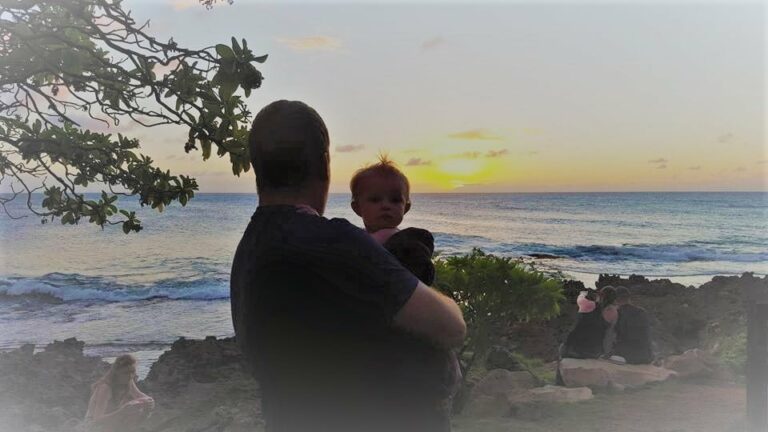

Our initial wake up call came in July 2015 when we took a trip to Hawaii that was placed completely on credit cards and cost well over $7,000. On that trip we discovered we were expecting another baby. Our first born, Lucy, was about 9 months old and this new pregnancy was not planned. Instead of being excited, we were scared.

Lucy’s hospital bills in October 2014 cost us well over $10,000, which we were still paying off, and the business we had invested in was not doing well, making my income almost a wash after travel and daycare expenses.

We had to make a new plan. But it wouldn’t be the typical plan. We went about it unconventionally based on our # 1 immediate goal which was to get my butt home full time with Lucy and the baby on the way. More on this in a bit.

Sadly, we miscarried that sweet baby soon after we got home from Hawaii. It was devastating. We got even more serious, knowing for sure we wanted to have another child and didn’t want the decision to ever be based on financial stability.

At no point, really, were we ever in trouble of not making our minimum payments. I feel lucky in the sense that our credit is good and other than the large balances, has no other bad marks. Shane has a very well paying job and covered the majority of those minimum payments.

We WERE, however, living on the edge.

If Shane had lost his job, or we had any other type of emergency, our only option would have been to default on some of our debt. We didn’t want that either. We accumulated that debt and we planned to pay off every last penny.

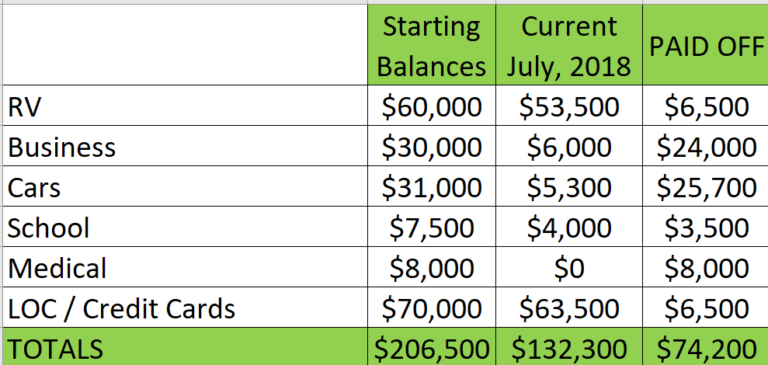

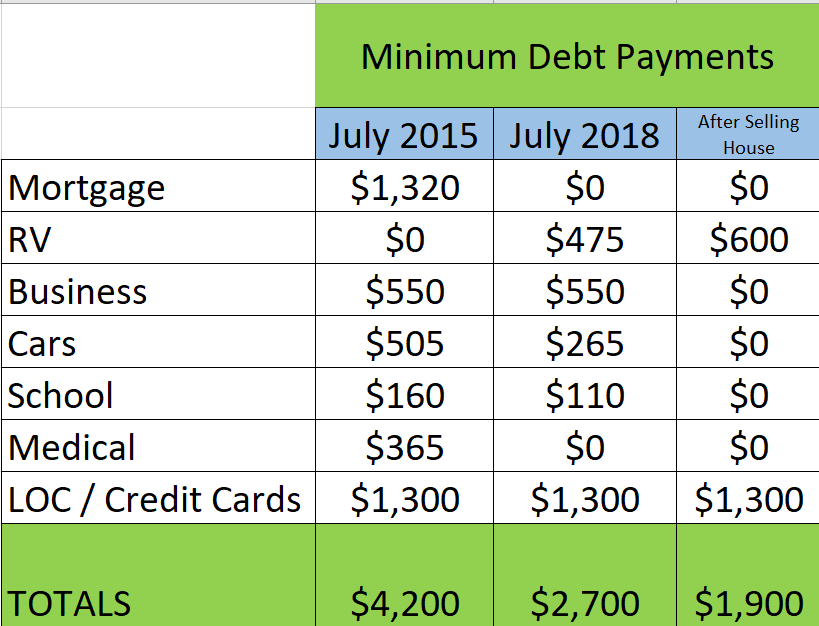

Here is a breakdown of what it looked like at it’s max combined with our RV loan, and what it looks like as of this month, July 2018. In total we have paid down, $74,200.

Typically, the most common advice given to get out of debt is to either

- Put the largest amount of money at the smallest balance owing, creating a snowball effect as it gets paid off. (future post on this method will be linked here)

OR

- Put the largest amount of money towards the highest interest rate balance, saving the largest amount in interest payments in the long run.

Even though both of those methods are very sound methods, our priority was to reduce our minimum payments as MUCH as possible so that I could get home full time as soon as possible. This meant somehow eliminating our largest payments and not following either of these suggested methods.

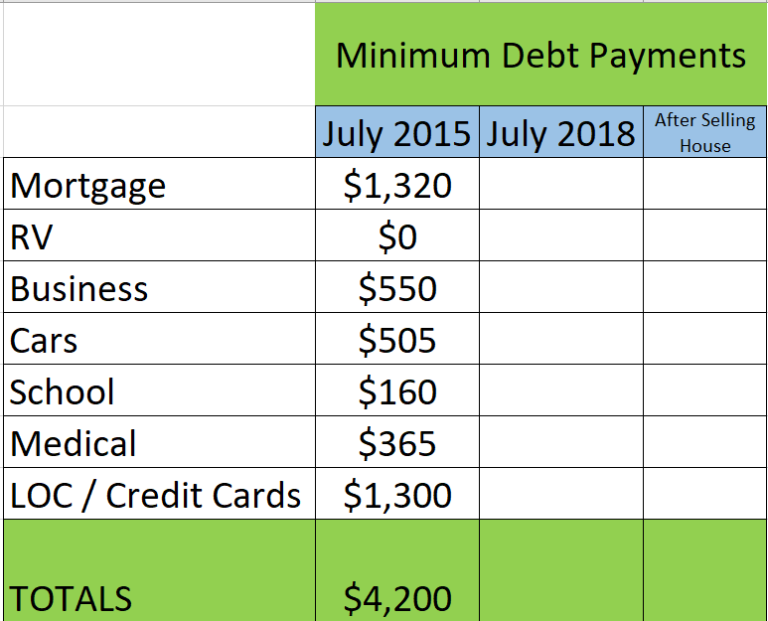

Our largest payments were our mortgage, car payments, medical bills and business loan. As of July 2015, here is what it looked like adding up to $4200 / month.

We came up with a crazy plan. We decided to work towards buying a 5th wheel and to then rent out our house. By July 2017 we moved into the 5th wheel and reduced our monthly minimums by almost $850, plus some additional non debt expenses. This reduction was the difference between what we were paying on our mortgage and our new RV payment. We also created a new long term goal to travel full time by November 2019 in our new RV.

We are CRAZY blessed that Shane’s parents are letting us live on the back portion of their property while we took on this initial stage of our plan. It was a huge relief as we tried to figure out how to pay more and more on the other pieces of our debt so I could get home with Lucy.

We have since experienced several more miscarriages and each time it has been a wake up call to move forward to pay off debt as fast as possible but also a reminder that my body was under a significant amount of stress due to my job. I was commuting almost an hour each way, each day, while slowly bringing home less and less income for our family.

I was gaining weight, I was unhappy and mentally felt like I was on the verge of breaking down. It finally got to the point that it was costing us money to send me to work. Among other factors, we had to make a drastic decision to get me home with Lucy much sooner than planned.

Even though we were still paying on the business loan, In January, 2018 the relief was felt almost immediately when I officially left the business and stayed home full time.Although we knew there was a lot of expense that came with me working 50 miles away and putting Lucy in daycare, we were a little surprised to start seeing a savings almost immediately and again started making good progress on our debt.

We have since paid off an additional car and the remaining balance on Lucy and my hospital bill’s. This has freed up an additional $600 per month.

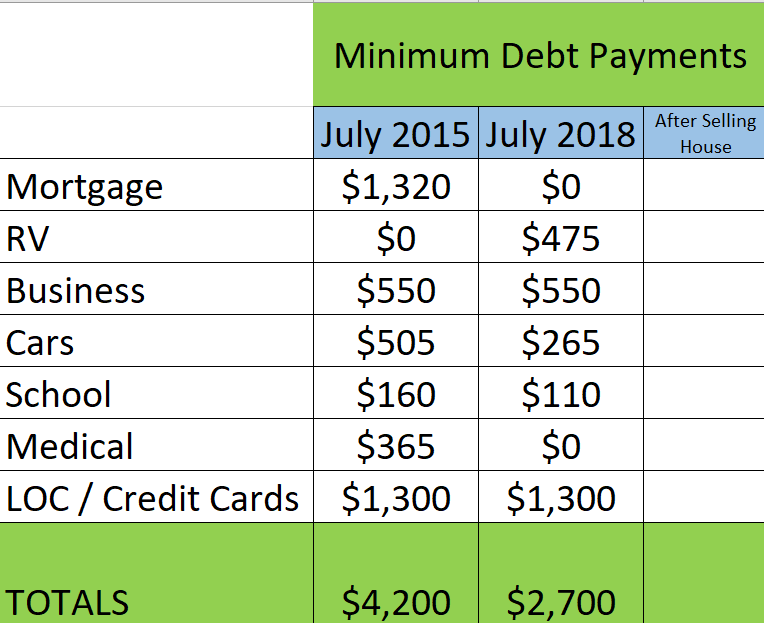

Here is what the minimum payments look like as of July 2018. A reduction of $1500 / month. (This is on top of our savings in daycare, gas and misc expenses to get me to work each day.)

WHAT’S NEXT?

We are putting our house up for sale and hoping to pull out about $25,000. This will pay off the remaining large balance items (aside from our RV) and free up an additional $900 a month in payments.

With that last big piece out of the way, we will then have the ability to refinance our RV, rolling an additional $10,000 into a lower interest rate. This will raise our RV payment but at this point the focus can be more on saving money in the long run. Interest is a big piece of that.

If it all goes as hoped, this will leave about $50,000 of credit card debt left to pay off. Our last and final piece of debt aside from the RV.

Here is what our minimum payments will look like once the house is sold and we are in that final stage of our plan.

50K is STILL A HUGE NUMBER.

But let me tell ya.

By doing things the way we did, we will have gone from $4,200 in minimum monthly payments in July 2015 to $1900 in monthly payments this coming fall. $2300 less per month than when we started.

It gave us breathing room, a chance for me to be pregnant again with less stress, an ability for me to be home full time with Lucy AND the ability to throw $3500 / month at the remaining debt that will go directly to principle. (and that is being conservative with our numbers.)

With this plan we SHOULD technically be out of debt, aside from the RV, in 14 to 18 months from the time we sell our house. We are giving ourselves a little wiggle room since we don’t know exactly how this current pregnancy will go. This baby is due in March, 2019.

It’s a hefty goal. But we are hopeful based on what we have accomplished so far that we will do it.

So there ya go, how we eliminated $74,200 in debt, got me home full time and how will be paying off an additional $75,000 in less than 1.5 years. From start to finish it will have taken us 4 to 5 years to pay down $148,700.

SO much can happen between now and the time we want to get on the road full time in November 2019. We are not blind to the idea that plans change. But for now, we feel good about life, our progress & our new baby on the way.

We are also excited about this new adventure of creating this website for people, like us, who refuse to settle. We are always progressing and always learning. As we learn more about the process of becoming debt free, we will be sharing about it in more posts to pass along to all of you.

We believe not any ONE PLAN works for everyone, there are many options out there and we plan to share them. Obviously we took a very unconventional way of going about it but will be excited to share all the various ideas and plans out there to help you on your own personal journey.

Did you find this post helpful, use the buttons below and share!